Alongside “Digital” and “AI,” “Programmatic Out-of-Home” (pDOOH) has become one of the most buzzworthy terms in the OOH media space. Promising automation, audience targeting, and operational efficiencies, it’s easy to see why marketers and media professionals are intrigued. Today, understanding programmatic is no longer optional—it’s expected as part of a modern marketer’s toolkit.

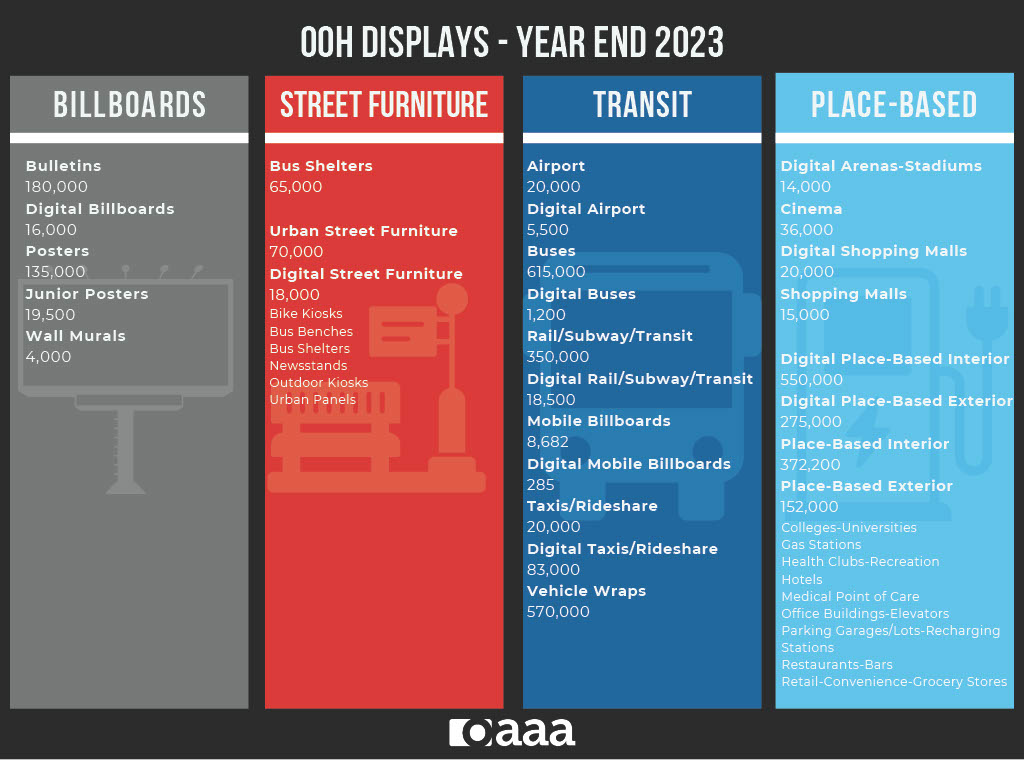

Yet, amid growing enthusiasm for Programmatic Out-of-Home, confusion persists. The Out-of-Home channel is frequently oversimplified, despite its vast and complex landscape. OOH encompasses a wide range of formats, placements, and capabilities. It supports full-funnel marketing objectives and varied messaging needs. Still, core terms—OOH, Digital OOH (DOOH), and programmatic OOH (pDOOH)—are often misused interchangeably, despite having distinct meanings. To solve increasingly complex marketing challenges, it’s essential to align on terms.

Programmatic Out-of-Home can be powerful, but it is not a standalone communications strategy. Nor is it a one-size-fits-all, comprehensive Out-of-Home media solution. pDOOH’s success depends not just on execution within the media mix, but also on how it’s integrated across the communications and OOH spectrum (including static placements), and mainly on how it delivers on a brand’s campaign objectives. Like all media, Out-of-Home (OOH) advertising demands an integrated and strategic approach to planning. Below are five reasons Programmatic Out-of-Home is not a cure-all, and why it demands thoughtful and specialized expertise.

1. The Digital Illusion: Inventory Limitations & Quality Control in Programmatic Out-of-Home

One common misconception is that Programmatic Out-of-Home offers the same scale and reach across the U.S. as digital display advertising. That’s false. OOH is inherently constrained—there are only a limited number of screens available in physical environments at any given moment. Unlike online, where impressions are limitless and not always viewed by real people, pDOOH operates within real-world limits.

Inventory availability fluctuates constantly. A strong pDOOH plan must consider both the screen universe and real-time market trading ‘pulse’. The right platform partner can optimize planning by managing a robust inventory pool; however, trade-offs are inevitable. Knowing when to use programmatic vs. direct buys and choosing the right platform is key to aligning media tactics with campaign goals.

Many media professionals focus narrowly on digital screens, overlooking the broader OOH ecosystem. This fixation risks missing critical touchpoints and undermining OOH’s unique value: its ability to command public attention in the physical world. A robust OOH strategy must consider audience, geography, locations, and the interplay of direct and programmatic tactics that can leverage production and messaging requirements.

A robust OOH strategy must consider audience, geography, locations, and the interplay of direct and programmatic tactics that can leverage production and messaging requirements.

Although growing, the programmatically available pool of premium Programmatic Out-of-Home screens remains limited. Complex creative executions often require Direct deals to guarantee placement and allow for customization and local relevance. The main point is to know why trading programmatically is necessary -and generally that’s for either accessibility for advertisers with budget constraints that preclude them from buying OOH on a Direct basis or for scale.

2. Fragmentation and Lack of Standardization

Despite ongoing consolidation, the Out-of-Home (OOH) industry remains largely fragmented. Inventory is spread across a patchwork of media owners, geographies, platforms, and data providers. Unlike digital display and video, OOH lacks universal technology standards, requiring nuanced expertise to navigate effectively.

Not all networks are connected programmatically. Some premium placements remain exclusive to direct deals, complicating national planning and making unified, scalable buys difficult. Meanwhile, metrics and reporting vary widely between vendors and platforms.

While impression-based buying is becoming more common, the metrics used are inconsistent. An “Opportunity to See” the digital standard is not the same as OOH’s “Likelihood to See.” Metric. This lack of standardization hampers cross-channel measurement and attribution, making it hard to compare Programmatic Out-of-Home with other digital channels. A “single source of truth” should be vetted around understood standards.

Marketers accustomed to unified dashboards may find pDOOH disjointed unless their partners are fluent in the nuances. This matters when assessing true performance. As with other media, there is no single metric that defines value; however, data to support strategic decisions based on campaign objectives should be readily available.

3. Data Quality, Attribution, and Transparency Challenges

Audience targeting is one of Programmatic Out-of-Home’s most touted benefits, but data quality varies. Many platforms rely on anonymized mobile location data, but differences in collection methods, accuracy, and audience segmentation raise valid concerns.

Marketers often have limited visibility into how audience segments are built or updated. Without transparency, trust in targeting and optimization suffers. Attribution—distinct from media measurement—also lags behind other digital formats. While solutions that link OOH exposure to digital actions or store visits are improving, many campaigns don’t include attribution due to additional costs beyond media space.

CPMs often include hidden platform or data fees, which can distort performance metrics. Moreover, few platforms specify the audience basis for CPMs, often omitting whether it’s a general or target audience. Marketers should push for clarity on audience definitions and costs.

Transparency must improve across the industry. Until clearer data standards and practices are established, marketers should critically evaluate all audience claims and ensure that the tools used align with their objectives.

4. Programmatic Out-of-Home Doesn’t Mean “Cheap”: Higher Costs: Media + Data + Technology

While automation is meant to increase efficiency, Programmatic Out-of-Home often comes with higher costs. Platform fees, data licensing, and tech markups are bundled into media CPMs. For campaigns prioritizing scale or reach, pDOOH may be less cost-effective than traditional OOH buys.

The perception that Programmatic Out-of-Home equals cheaper media is misguided. Research, analytics, and campaign tracking add value—but also cost. “Proof of posting” remains a basic— and insufficient —standard in Out-of-Home (OOH) advertising. Modern marketers demand accountability: not just that the ad was displayed, but that it effectively delivered on audience goals.

Campaign verification technology is essential across all Out-of-Home (OOH) formats, whether traded directly or programmatically. However, until OOH operations become more standardized, they will remain more labor-intensive than digital or broadcast operations.

Unlike traditional OOH, pDOOH doesn’t easily allow for custom pricing, long-term discounts, or value-added placements—common benefits of long-standing media partnerships. While custom PMP deals are possible, setting them up requires nearly as much offline work as traditional buying. According to one major pDOOH DSP:

“Private deals, accounting for 95% of spend on the Place Exchange platform, remained strongly preferred over open auction buying, as they offer highly flexible campaign delivery, transparency around media pricing, and certainty around inventory quality – all factors that are growing in importance to buyers.”

Agencies and marketers must weigh the operational efficiency of pDOOH against total campaign costs and ensure they’re aligning media decisions with value, not just automation. In an omni-channel world, siloing “OOH,” “Digital,” or “Search” is outdated. Digital and AI aren’t just channels—they’re cross-functional tools.

5. Steep Learning Curve and Internal Silos

Although Programmatic Out-of-Home resembles digital buying, it doesn’t neatly fit into traditional digital team structures. Who owns it—the digital team, OOH team, or programmatic buying group? Without clear ownership and expertise, campaigns risk strategic misalignment.

pDOOH requires knowledge of physical environments, audience flow, screen context, and creative limitations—elements digital-only teams may overlook. Meanwhile, the programmatic landscape, comprising DSPs, SSPs, data vendors, and measurement tools, introduces its own complexity.

Without training or strong partnerships and understanding of the channel, teams may struggle to effectively adopt pDOOH, which can have negative consequences on campaign performance. Success requires cross-functional collaboration and potentially new organizational models that reflect today’s hybrid media realities.

The Future for Programmatic Out-of-Home is bright, but we’re not there yet:

Programmatic Out-of-Home isn’t a silver bullet—but in expert hands, it’s a powerful tool. When used strategically, it adds automation and precision to a medium defined by physical presence and public impact.

However, unlocking pDOOH’s full potential requires more than simply flipping a switch. It requires informed planning, integration across Out-of-Home (OOH) formats, and collaboration with partners who understand the landscape. pDOOH is a valuable tactic, not a replacement strategy. Its role must be clearly defined within a modern, hybrid media plan.

As the market continues to evolve, it’s important for brand marketers, media planners, and OOH to ask:

- When does OOH make sense for our brand and campaign goals in the long and short term (within the confines of any given campaign’s parameters)?

- What messaging is needed and when (full funnel > from awareness to sales) – is this the same everywhere? Does messaging need to hit all at once?

- What assets are out there and where /how can we leverage them most efficiently and make them contextually and culturally relevant?

- Does OOH and DOOH trading programmatically align with our goals?

- What trading strategies should we deploy?

- What OOH media KPI’s should we establish (can be anything so long as they are measurable and aligned with business and marketing KPI’s).

- How will we assess performance? Are we set up to measure, optimize, and manage pDOOH campaigns effectively?

OOH remains one of the most creative and impactful channels available. Its ability to shape public experiences, amplify social content, and create memorable moments makes it uniquely positioned in a crowded digital ecosystem.

The most effective Out-of-Home (OOH) plans today are hybrid, combining guaranteed placements with programmatic agility. As the Programmatic Out-of-Home infrastructure matures and reporting becomes a baseline expectation, marketers will be better equipped to create integrated, accountable, and high-performing campaigns.

Bring it on!

Learn More about Programmatic Out-of-Home:

Want to learn more about how you can strategically use Programmatic Out-of-Home to enhance and compliment your full campaign. Contact us to set up call.

Glossary

OOH encompasses all media in the public’s space (digital and printed), from Outdoor (Billboards and Street Furniture) to Transit (in and on stations, exteriors, in and on vehicles/cars), to Place-Based in select environments like gyms, gas stations, medical offices, theaters, sports venues and airports. Non-traditional, ambient, or experiential opportunities not tied to a fixed route or geography are also part of the channel.

DOOH refers specifically to digital screens in public spaces that span OOH categories.

Programmatic OOH, or more specifically, Programmatic DOOH (pDOOH), is a buying method that leverages data and automation to purchase ad space on DOOH inventory in real-time.

Global OOH Direct-pDOOH Trading

According to VIOOJ reporting, the flexibility to reach either a broadcast or target audience and the ability to change messaging in real-time are most important to advertisers. Integrating pDOOH more closely into multi-channel campaigns is also key. Most US advertisers believe that pDOOH is more important for brand-led activations (78%) compared to performance-led campaigns (76%). In contrast, the reverse is true globally across all markets, with 83% prioritizing performance-led campaigns and 77% prioritizing brand-led campaigns.

ADDENDUM – AIRPORT & Premium assets

A real tension in the evolution of Digital Out-of-Home (DOOH) and in turn pDOOH, especially in premium environments like Airports, is that it’s manually controlled. For example, Direct trading terms still rely on archaic Out-of-Home (OOH) trading terms, such as continuous 4-week ad cycles, without any research to support this term as an optimal flight term. These are the key challenges as to why DOOH and pDOOH are not the ‘silver bullet’ and make planning OOH in a strategic way so challenging:

1. Legacy Industry Standards

The OOH industry, including space in environments such as transit and Airports, has historically traded in continuous blocks of 4-week ad cycles—a structure inherited from traditional print-based OOH (e.g., static billboards). These cycles became baked into media planning systems, rate cards, and buyer expectations. They are as old or perhaps older than the legacy “Daily Effective Circulation” (DEC) metric. Despite tech capabilities, even as screens have become digital, the buying frameworks haven’t fully evolved.

2. Lack of Incentive for Change (Especially for Premium Inventory)

Premium DOOH inventory – specifically Digital “Spectaculars” and screens in key environments like Airports is often perceived as premium, high-impact inventory. Media owners have little incentive to modernize trading terms when demand remains high under the current model. Selling 4-week packages and providing little to no audience data allows for more flexible pricing and easier inventory management, thereby reducing fragmentation and operational complexity.

3. Operational Simplicity

Selling in 4-week blocks simplifies inventory forecasting, pricing, and campaign management — especially for media owners who haven’t fully adopted programmatic infrastructure. Continuous cycles make it easier for Suppliers to package and bundle locations across an airport or network.

4. Limited Research on Optimal Flighting

Unlike digital media, which is rich in performance data, DOOH — especially in Transit and Airport environments — lacks deep, consistent research on optimal flighting or frequency models. This makes it hard to justify shorter, more targeted campaigns from a media owner’s perspective. Until robust, real-time measurement becomes mainstream, the status quo persists.

5. Misalignment with Digital (and OOH) Buyer Expectations

Traditional OOH buying teams often remain siloed from digital media planners. As a result, a gap in expectations exists: OOH buyers are accustomed to upfront commitments and long lead times, while digital buyers expect flexibility, shorter timelines, and real-time optimization, which direct buys can’t yet deliver.

6. Slow Adoption of Programmatic Out-of-Home

While programmatic DOOH (pDOOH) offers flexible flighting, real-time targeting, and dynamic creative, premium screens, including large-format billboards, Spectaculars, and key screens in Airport, Mall, and Transit environments have been slower to adopt programmatic pipes at scale. Many airports still don’t offer full SSP/SSO integration, and even where available, not all inventory is accessible programmatically.

Summary:

Despite tech capabilities and the clamor for ‘audience measurement’ and outcome (attribution) solutions, OOH still operates on a legacy trading basis. Suppliers rule the roost and hold on to legacy trading terms, including 4-week ad cycles, due to a mix of tradition, operational simplicity, limited measurement, and lack of urgency to change, despite the flexibility digital screens could technically offer.