As we move into 2023 events are back in full swing, and there are some interesting trade show marketing trends developing as things are really ramping up for the spring trade show season. It’s time for our quarterly pause to take stock of what’s been happening in the industry.

Through the last year, we’ve had the opportunity to observe a number of industry conferences for our clients, and activity is continuing to pick up. We’ve also attended some industry events like the IAEE ExpoExpo! and the annual Healthcare Convention & Exhibitors Association (HCEA) conference, where I had the opportunity to speak on a panel titled “Puppies, Pastries, and Panic Rooms: Compliant Engagement in 2023”.

These are the Trade Show Marketing trends we are seeing and hearing from attendees, exhibitors, and those in the conference industry.

Nobody wants to return to virtual trade shows, but hybrid events are here to stay.

Virtual events were a necessity during Covid, but let’s be honest – no one really liked them that much, and they lacked some of the most critical aspects of in-person events – the ability to connect in real life, the opportunity to have spontaneous conversations, the chance for attendees to test and see new products. It also made it difficult for exhibitors to distinguish themselves when everyone was limited to the same channel. Exhibitors did what they could with what was available – but now they want more.

Now that in-person events are entirely back, exhibitors are all in and do not want to go back. They have learned through Covid how much they were missing from in-person shows. This corroborates what we saw in our study on exhibitor attitudes toward sponsorships, where 68% strongly agree that in-person events provide a much better return on investment than virtual events.

That’s not to say that many events won’t retain a hybrid component; they certainly will. Hybrid offers another channel to engage their base. Because they can offer a lower cost of entry, organizations can leverage them to interact with an audience that may not be able to make the event in person. Hybrid components also allow events to offer other sponsorship opportunities, thus increasing their potential non-dues revenue.

Slightly Lower Attendance – But Mostly Decision Makers:

In general, we are seeing slightly lower attendance at events as they are coming back. This is the result of several factors. Many companies are still restricting travel somewhat, so they may authorize fewer events and smaller contingents. There are also budgetary concerns in play. As many organizations climb out of the economic pit of the pandemic, there are still spending restrictions in place, and they are just not spending as much on travel.

There is a flip side to this trend, however, and this is something we are definitely hearing from exhibitors. While there may be slightly smaller crowds, those attending are almost all in positions of authority with decision-making power. When companies are making cuts about who can attend, it is usually the junior team members who get cut first. That means that the people in attendance have an even higher concentration of decision-makers than before Covid. It also means that exhibitors can spend more time with each attendee. If the crowd at your booth is slightly smaller it reduces the pressure to jump from person to person and interact with everyone and instead emphasizes the quality and depth of the connections made.

Smaller Booths But More Engagement:

Having the biggest, flashiest booth at the show has always been a goal and priority for many exhibitors, particularly when faced with the prospect of outdoing your competitor, who is right across the aisle. However, with slightly smaller numbers of attendees, and the need to maximize revenue opportunities from their event investment, exhibitors are spending more time focusing on how to optimize engagement.

This is also allowing exhibitors to rethink their event budgets. Traditionally the cost of the booth was a large portion of the budget, and while that is still true, it’s not as large. This means that exhibitors can direct that budget to other things – whether that’s external private events, taking advantage of more sponsorship opportunities, or extending their marketing efforts before, during, and after the show.

Engagement With the Experts:

With the emphasis on engagement, attendees are looking for an elevated experience. There is an increasing demand for subject matter experts (SMEs) to be part of the booth experience to be able to give more in-depth and higher-level explanations of new products and services. For example, doctors want to be able to talk to other doctors who may have a more expert and nuanced understanding and be able to have a more informed discussion.

This trade show marketing trend is prompting exhibitors to responding by shifting their staffing away from traditional sales and including more SMEs as an essential part of their staff. This also allows the exhibitors to shift the focus away from the booth size to the people and experience within.

Activities Outside the Conference Floor:

Between keynote speakers, training sessions, specialty tracks ,and the exhibit floor, an attendee’s schedule can fill up pretty quickly, and they end up spending most of their hours inside, bouncing from session to session. This can get overwhelming pretty quickly, and many attendees end up never seeing the city they have traveled to.

One thing we’ve learned from the last few years is the importance of maintaining a balance, and attendees expect to see that in the conferences they attend as well. We are seeing a growing demand for more organized activities that take place outside the convention center. These can take the form of guided city walks, 5K runs, morning yoga sessions, and more.

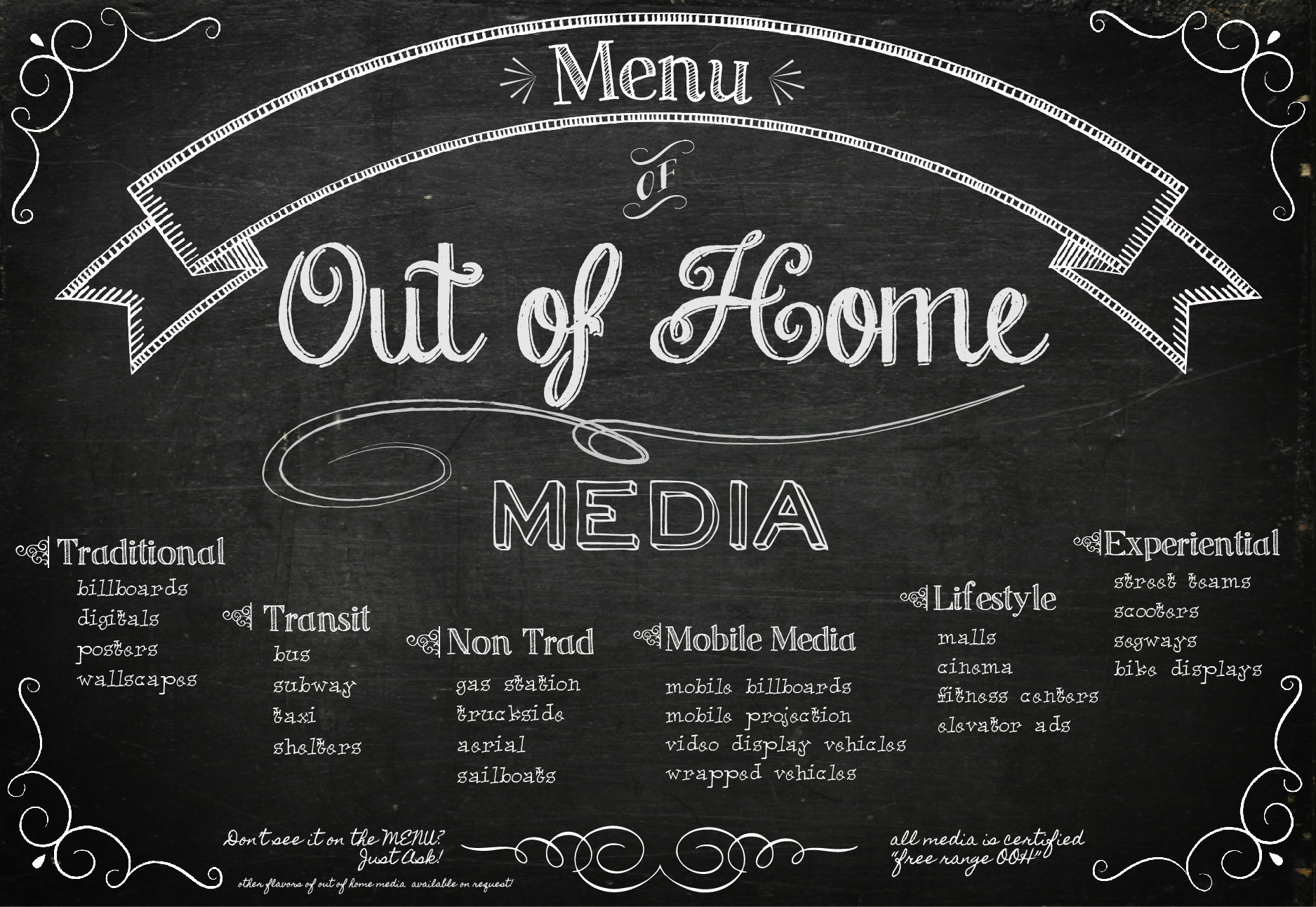

With attendees wanting more organized activities outside the exhibit floor, this provides an opportunity for exhibitors to expand their presence and engage attendees with external/city-wide promotional advertising.

“Bleisure” Travel is becoming a higher priority:

While most trade show marketing trends apply directly to the conference, some of them are related to the overall attendee experience. The idea of combining business and leisure travel is nothing new, but it has taken on a higher priority since Covid. With pent-up travel demand, we are hearing from many attendees are making up for lost opportunities and extending their stay in a host city, either pre or post-conference, bringing family along to make the most of the trip. For employers, it offers benefits as well. Allowing employees to combine priorities, it means missing less time with loved ones, making the prospect of business travel more appealing.

The impact of this can influence event organizers in a number of ways. When considering what markets to select to host their event, organizations should now consider who their attendees are, what their outside interests might be, who they might be bringing with them, and what attractions or leisure opportunities are available in the host city. The timing could be affected as well. While event season typically peaks in the Spring and Fall, there are events that happen at other times; considering the seasonality of the destination city can also factor into the desirability for attendees.

Keeping Tabs on Trade Show Marketing Trends:

As the industry continues to rebound it is also reshaping itself and responding to both attendee and exhibitors needs. Event organizations are taking long looks at the whole conference experience to see where they can optimize for everyone involved and deliver the best experience possible. One key takeaway from the pandemic was the Event Organizations had to learn to be more adaptable and move more quickly than ever before. As they continue to employ those new skills we’ll keep watching to see how the conference space evolves.